How QuickBooks Self Employed Can Simplify Freelancer Taxes sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. As freelancers navigate the complexities of tax management, QuickBooks Self Employed emerges as a valuable ally in simplifying the process and maximizing deductions.

With its key features designed to streamline income and expense tracking, offer guidance on tax deductions, simplify invoicing, and aid in quarterly tax estimations, QuickBooks Self Employed revolutionizes how freelancers approach their taxes. Let's delve into the specifics of how this software can transform the way freelancers manage their finances and tax obligations.

Overview of QuickBooks Self Employed for Freelancer Taxes

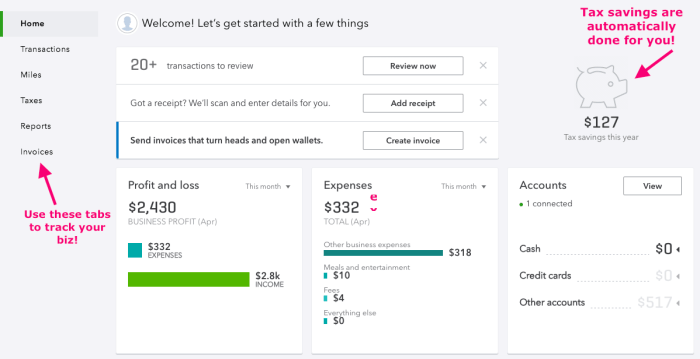

QuickBooks Self Employed is a specialized tool designed to simplify tax management for freelancers. It offers a range of features that streamline the tax process and help freelancers stay organized throughout the year.

Key Features of QuickBooks Self Employed

- Automatic Expense Tracking: QuickBooks Self Employed automatically tracks and categorizes your expenses, making it easier to claim deductions and maximize tax savings.

- Invoicing and Payment Tracking: Freelancers can create and send professional invoices, as well as track payments, helping to ensure accurate income reporting for tax purposes.

- Mileage Tracking: The app allows freelancers to track their mileage for business-related travel, which can be a valuable deduction come tax time.

- Tax Estimation: QuickBooks Self Employed provides estimates of quarterly tax payments based on income and expenses, helping freelancers plan and budget accordingly.

The Importance of Using QuickBooks Self Employed for Freelancer Taxes

Utilizing a specialized tool like QuickBooks Self Employed is crucial for freelancers to effectively manage their taxes. By automating processes, tracking expenses, and providing tax estimates, freelancers can save time and ensure accuracy in their tax filings. This can lead to fewer errors, potential tax savings, and peace of mind knowing that their financial records are organized and up-to-date.

Tracking Income and Expenses

QuickBooks Self Employed offers freelancers a streamlined way to track their income and expenses, making tax time less stressful. By utilizing the software, freelancers can easily categorize their transactions, ensuring accurate records for tax purposes.

Categorizing Transactions

- Income: Freelancers can categorize income from various sources such as client payments, online sales, or royalties. This helps in identifying the different streams of revenue.

- Expenses: Expenses like office supplies, travel costs, or software subscriptions can be categorized to track spending and maximize deductions.

- Mileage: QuickBooks Self Employed enables freelancers to track mileage for business trips, which can be crucial for deducting vehicle expenses.

Benefits of Accurate Tracking

- Maximized Deductions: By categorizing income and expenses correctly, freelancers can identify deductible expenses and maximize tax deductions.

- Tax Compliance: Accurate tracking ensures that freelancers have organized records to comply with tax regulations and easily prepare tax returns.

- Financial Insights: Monitoring income and expenses provides freelancers with insights into their financial health, helping them make informed decisions for their business.

Tax Deductions Guidance

When it comes to tax deductions, QuickBooks Self Employed is a valuable tool for freelancers to maximize their savings. The software provides guidance and support in identifying eligible deductions, ensuring that freelancers can accurately track and claim expenses to reduce their taxable income.

Common Tax Deductions

- Home office expenses, such as rent, utilities, and internet costs

- Business travel expenses, including transportation, lodging, and meals

- Professional services fees, like those paid to accountants or lawyers

- Office supplies and equipment purchases

- Health insurance premiums for self-employed individuals

Maximizing Deductions

QuickBooks Self Employed helps freelancers understand the importance of maximizing deductions to reduce their taxable income. By accurately tracking and categorizing expenses, freelancers can ensure they are claiming all eligible deductions, ultimately lowering their tax liability and increasing their overall savings.

Simplified Invoicing and Payment Tracking

Invoicing and keeping track of payments are essential tasks for freelancers to ensure they get paid on time and maintain accurate financial records. QuickBooks Self Employed offers features to simplify these processes, making it easier for freelancers to manage their invoicing and payment tracking efficiently.

Invoicing Features of QuickBooks Self Employed

- Customizable invoice templates: Freelancers can create professional-looking invoices with customizable templates that include their logo, business information, and payment terms.

- Automatic invoice generation: The software can automatically generate invoices based on tracked billable hours or expenses, saving freelancers time and reducing manual errors.

- Invoice tracking: Freelancers can easily track the status of sent invoices, including whether they have been viewed, paid, or are overdue.

Tracking Payments and Outstanding Invoices

- Payment reminders: QuickBooks Self Employed can send automated payment reminders to clients for outstanding invoices, helping freelancers maintain a steady cash flow.

- Payment reconciliation: Freelancers can reconcile payments received with their invoices directly within the software, ensuring accurate financial records.

- Real-time payment tracking: The software provides real-time updates on payments received, allowing freelancers to stay on top of their finances.

Impact of Streamlined Invoicing on Tax Reporting and Financial Organization

- Efficient tax reporting: By maintaining organized and up-to-date invoicing records, freelancers can easily generate reports for tax purposes, ensuring compliance with tax regulations.

- Improved financial organization: Simplified invoicing and payment tracking help freelancers maintain a clear overview of their income and expenses, making it easier to manage their finances and plan for the future.

- Time-saving benefits: Automating invoicing processes and payment tracking can save freelancers valuable time that can be better spent on growing their business or taking on new projects.

Quarterly Tax Estimations

QuickBooks Self Employed offers freelancers a valuable tool to estimate quarterly taxes accurately and efficiently. By utilizing this feature, freelancers can stay on top of their tax obligations throughout the year and avoid any surprises come tax season.

Utilizing QuickBooks Self Employed for Accurate Tax Estimations

- Inputting Income and Expenses: Freelancers can easily track their income and expenses within the platform, providing a clear picture of their financial standing.

- Automatic Tax Calculations: QuickBooks Self Employed automatically calculates quarterly estimated tax payments based on the income and expenses recorded, simplifying the estimation process.

- Access to Tax Reports: The software generates detailed tax reports that can be used to review and verify the accuracy of the estimated tax amounts.

Importance of Staying Compliant with Quarterly Tax Payments

- Avoiding Penalties: By making timely and accurate quarterly tax payments, freelancers can avoid costly penalties and interest charges.

- Smooth Cash Flow Management: Quarterly tax payments help freelancers manage their cash flow effectively by spreading out their tax obligations throughout the year.

- Peace of Mind: Staying compliant with quarterly tax payments gives freelancers peace of mind knowing that they are meeting their tax responsibilities and avoiding any potential issues with the IRS.

Integration with Tax Filing

QuickBooks Self Employed offers seamless integration with tax filing processes, making it easier for freelancers to manage their taxes efficiently. By connecting your QuickBooks account to popular tax filing platforms, such as TurboTax, users can streamline the transfer of financial data from the software directly to their tax forms.

Benefits of Seamless Data Transfer

- Eliminates manual data entry errors: With integrated tax filing, the risk of inaccuracies in transferring income, expenses, and deductions is significantly reduced.

- Saves time and effort: By automatically syncing your financial data, freelancers can save valuable time that would have been spent on manual data entry.

- Ensures compliance: Integration with tax filing platforms helps freelancers stay compliant with tax regulations by accurately reporting their income and expenses.

Convenience of Integrated Platforms

- Single platform for financial management: Freelancers can use QuickBooks Self Employed not only for tracking income and expenses but also for preparing and filing taxes seamlessly.

- Real-time updates: Integrated platforms provide real-time updates on tax obligations and deadlines, helping freelancers stay organized and on top of their tax responsibilities.

- Effortless tax filing: With the direct transfer of financial data to tax forms, freelancers can file their taxes quickly and efficiently, reducing the stress associated with tax season.

Conclusion

In conclusion, QuickBooks Self Employed stands out as a game-changer for freelancers looking to streamline their tax processes. By offering comprehensive tools for tracking income, managing expenses, identifying deductions, and estimating quarterly taxes, this software empowers freelancers to take control of their financial responsibilities with ease.

Embracing QuickBooks Self Employed can lead to not only simplified tax reporting but also enhanced financial organization and peace of mind.

FAQ

How does QuickBooks Self Employed help freelancers with tax management?

QuickBooks Self Employed simplifies tax management for freelancers by offering features for tracking income, categorizing expenses, identifying deductions, and estimating quarterly taxes.

What are some common tax deductions that freelancers can claim through QuickBooks Self Employed?

Freelancers can claim deductions for expenses such as home office costs, travel expenses, professional fees, and equipment purchases through QuickBooks Self Employed.

Can QuickBooks Self Employed assist freelancers in tracking their payments and outstanding invoices?

Yes, QuickBooks Self Employed provides invoicing features that allow freelancers to track payments, send invoices, and monitor outstanding invoices efficiently.

How can freelancers utilize QuickBooks Self Employed for accurate tax estimations?

Freelancers can use QuickBooks Self Employed to input their income, expenses, and deductions to generate accurate estimates for quarterly tax payments.